All Categories

Featured

Table of Contents

On the other hand, if a customer needs to give for an unique needs youngster that may not have the ability to manage their very own cash, a trust can be added as a beneficiary, permitting the trustee to manage the distributions. The type of beneficiary an annuity proprietor picks affects what the beneficiary can do with their acquired annuity and exactly how the proceeds will certainly be tired.

Numerous contracts permit a spouse to determine what to do with the annuity after the owner passes away. A spouse can change the annuity contract into their name, thinking all policies and rights to the first agreement and postponing instant tax repercussions (Guaranteed return annuities). They can gather all continuing to be payments and any survivor benefit and pick recipients

When a spouse ends up being the annuitant, the partner takes over the stream of repayments. Joint and survivor annuities additionally enable a named recipient to take over the agreement in a stream of payments, instead than a lump sum.

A non-spouse can just access the marked funds from the annuity proprietor's first arrangement. Annuity proprietors can choose to mark a trust fund as their beneficiary.

How can an Annuities For Retirement Planning protect my retirement?

These differences mark which recipient will get the entire fatality benefit. If the annuity owner or annuitant dies and the key recipient is still alive, the primary recipient gets the death benefit. If the key recipient predeceases the annuity proprietor or annuitant, the death benefit will go to the contingent annuitant when the owner or annuitant passes away.

The owner can transform beneficiaries at any moment, as long as the agreement does not call for an unalterable recipient to be called. According to skilled factor, Aamir M. Chalisa, "it is very important to comprehend the importance of designating a recipient, as selecting the incorrect recipient can have serious consequences. A lot of our customers choose to name their underage children as recipients, typically as the main beneficiaries in the lack of a spouse.

Proprietors who are married ought to not presume their annuity instantly passes to their partner. Often, they go with probate. Our short quiz gives quality on whether an annuity is a clever choice for your retired life profile. When picking a recipient, consider aspects such as your connection with the person, their age and how inheriting your annuity could affect their financial situation.

The recipient's connection to the annuitant generally identifies the regulations they comply with. A spousal beneficiary has even more options for dealing with an inherited annuity and is dealt with more leniently with taxes than a non-spouse recipient, such as a youngster or various other household participant. Intend the owner does decide to call a kid or grandchild as a beneficiary to their annuity

What should I look for in an Tax-efficient Annuities plan?

In estate preparation, a per stirpes classification specifies that, needs to your beneficiary pass away before you do, the beneficiary's offspring (youngsters, grandchildren, et cetera) will certainly get the fatality benefit. Get in touch with an annuity professional. After you have actually chosen and named your beneficiary or beneficiaries, you must remain to assess your choices a minimum of yearly.

Keeping your classifications approximately date can guarantee that your annuity will certainly be handled according to your wishes must you pass away suddenly. A yearly review, significant life occasions can prompt annuity proprietors to take another appearance at their recipient choices. "Someone could intend to update the beneficiary classification on their annuity if their life conditions alter, such as marrying or separated, having youngsters, or experiencing a death in the household," Mark Stewart, CPA at Detailed Organization, told To alter your beneficiary classification, you have to get to out to the broker or agent who manages your contract or the annuity supplier itself.

How can an Income Protection Annuities protect my retirement?

As with any type of financial product, seeking the aid of a financial advisor can be useful. An economic organizer can direct you via annuity management procedures, consisting of the approaches for updating your agreement's beneficiary. If no recipient is called, the payment of an annuity's survivor benefit goes to the estate of the annuity holder.

To make Wealthtender complimentary for viewers, we make money from marketers, consisting of monetary experts and companies that pay to be featured. This produces a conflict of passion when we favor their promo over others. Wealthtender is not a client of these monetary solutions providers.

As an author, it is just one of the very best praises you can give me. And though I really appreciate any of you investing several of your active days reviewing what I write, slapping for my article, and/or leaving appreciation in a comment, asking me to cover a subject for you genuinely makes my day.

It's you saying you trust me to cover a topic that is essential for you, and that you're positive I would certainly do so better than what you can already find online. Pretty spirituous stuff, and a responsibility I do not take most likely. If I'm not acquainted with the topic, I investigate it online and/or with get in touches with who know more concerning it than I do.

How do I choose the right Senior Annuities for my needs?

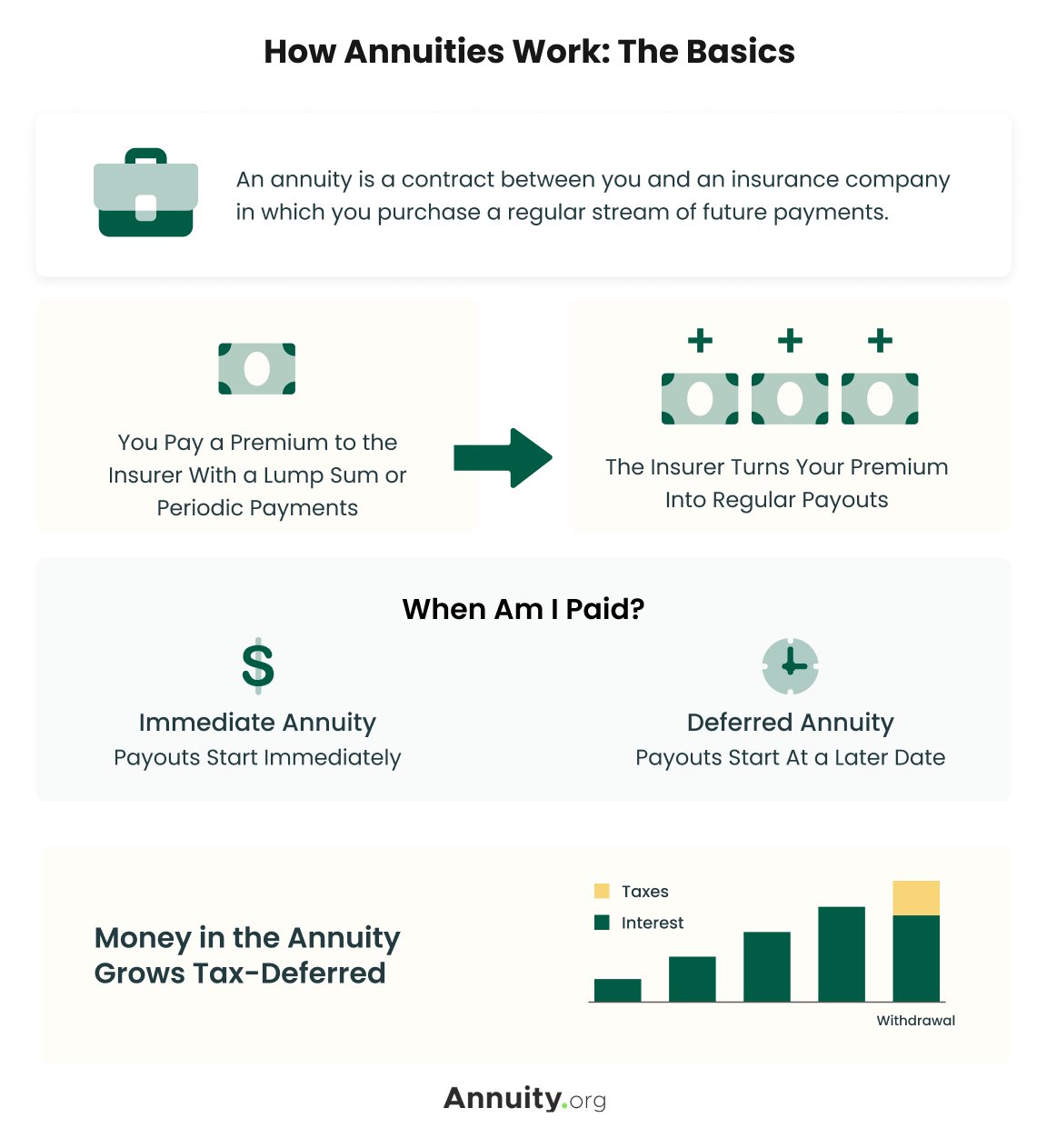

In my friend's case, she was assuming it would certainly be an insurance coverage of kinds if she ever before goes into nursing home care. Can you cover annuities in a post?" So, are annuities a valid suggestion, an intelligent transfer to safeguard surefire revenue for life? Or are they an unethical advisor's way of fleecing unwary clients by encouraging them to move properties from their profile right into a difficult insurance policy product plagued by extreme fees? In the most basic terms, an annuity is an insurance coverage product (that only certified agents might sell) that ensures you monthly repayments.

This normally uses to variable annuities. The even more riders you tack on, and the much less threat you're eager to take, the lower the repayments you ought to expect to receive for a provided costs.

How do I get started with an Fixed Vs Variable Annuities?

Annuities chose correctly are the best choice for some individuals in some circumstances. The only way to understand for sure if that includes you is to initially have an extensive monetary plan, and afterwards find out if any kind of annuity alternative uses sufficient advantages to validate the prices. These expenses consist of the dollars you pay in costs of training course, however additionally the opportunity price of not spending those funds in different ways and, for much of us, the influence on your ultimate estate.

Charles Schwab has a cool annuity calculator that shows you approximately what settlements you can anticipate from repaired annuities. I utilized the calculator on 5/26/2022 to see what an instant annuity might payment for a single costs of $100,000 when the insured and partner are both 60 and reside in Maryland.

Table of Contents

Latest Posts

Decoding Variable Annuity Vs Fixed Annuity Everything You Need to Know About Fixed Interest Annuity Vs Variable Investment Annuity Defining Annuities Variable Vs Fixed Advantages and Disadvantages of

Breaking Down Annuities Variable Vs Fixed Everything You Need to Know About Fixed Index Annuity Vs Variable Annuity Breaking Down the Basics of Fixed Indexed Annuity Vs Market-variable Annuity Feature

Highlighting Fixed Vs Variable Annuities A Closer Look at How Retirement Planning Works What Is Fixed Indexed Annuity Vs Market-variable Annuity? Features of What Is Variable Annuity Vs Fixed Annuity

More

Latest Posts