All Categories

Featured

Table of Contents

Keep in mind, nonetheless, that this doesn't say anything concerning adjusting for rising cost of living. On the plus side, even if you think your alternative would be to buy the securities market for those 7 years, which you would certainly get a 10 percent yearly return (which is much from specific, particularly in the coming years), this $8208 a year would be greater than 4 percent of the resulting nominal supply worth.

Example of a single-premium deferred annuity (with a 25-year deferment), with 4 payment alternatives. The regular monthly payment right here is highest possible for the "joint-life-only" alternative, at $1258 (164 percent greater than with the immediate annuity).

The way you buy the annuity will determine the solution to that inquiry. If you get an annuity with pre-tax bucks, your premium minimizes your taxed earnings for that year. According to , getting an annuity inside a Roth strategy results in tax-free settlements.

Fixed Vs Variable Annuities

The expert's very first action was to develop a detailed economic prepare for you, and afterwards explain (a) how the proposed annuity suits your general strategy, (b) what options s/he considered, and (c) just how such alternatives would certainly or would certainly not have actually resulted in lower or greater compensation for the expert, and (d) why the annuity is the superior option for you. - Retirement annuities

Naturally, an advisor may attempt pushing annuities even if they're not the most effective fit for your circumstance and goals. The factor could be as benign as it is the only item they market, so they drop prey to the typical, "If all you have in your tool kit is a hammer, rather soon every little thing starts looking like a nail." While the expert in this circumstance may not be dishonest, it boosts the danger that an annuity is a poor option for you.

What is the difference between an Annuity Accumulation Phase and other retirement accounts?

Since annuities typically pay the agent offering them much higher payments than what s/he would certainly obtain for investing your money in common funds - Annuities for retirement planning, not to mention the absolutely no payments s/he 'd obtain if you buy no-load common funds, there is a big motivation for agents to push annuities, and the a lot more difficult the much better ()

A dishonest consultant suggests rolling that quantity right into new "far better" funds that simply occur to lug a 4 percent sales load. Agree to this, and the expert pockets $20,000 of your $500,000, and the funds aren't most likely to do much better (unless you chose a lot more improperly to begin with). In the exact same example, the expert can steer you to buy a difficult annuity with that $500,000, one that pays him or her an 8 percent payment.

The expert attempts to hurry your choice, declaring the deal will quickly disappear. It might certainly, but there will likely be similar offers later on. The expert hasn't found out how annuity settlements will certainly be taxed. The expert hasn't revealed his/her payment and/or the costs you'll be charged and/or hasn't revealed you the impact of those on your eventual repayments, and/or the compensation and/or charges are unacceptably high.

Present passion rates, and therefore projected repayments, are traditionally low. Also if an annuity is best for you, do your due persistance in contrasting annuities marketed by brokers vs. no-load ones sold by the providing company.

What should I look for in an Annuity Income plan?

The stream of month-to-month repayments from Social Safety and security resembles those of a deferred annuity. In truth, a 2017 comparative analysis made a comprehensive contrast. The adhering to are a few of one of the most salient points. Considering that annuities are volunteer, the individuals purchasing them typically self-select as having a longer-than-average life span.

Social Safety benefits are completely indexed to the CPI, while annuities either have no rising cost of living defense or at the majority of supply an established percent yearly increase that might or may not compensate for rising cost of living in complete. This kind of cyclist, just like anything else that increases the insurer's danger, needs you to pay even more for the annuity, or accept reduced payments.

How do I receive payments from an Tax-deferred Annuities?

Please note: This post is meant for educational purposes just, and need to not be considered economic recommendations. You ought to consult an economic professional before making any significant monetary choices. My job has actually had several uncertain spins and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in speculative cosmic-ray physics (consisting of a number of check outs to Antarctica), a brief stint at a little design solutions company supporting NASA, complied with by starting my own little consulting technique supporting NASA tasks and programs.

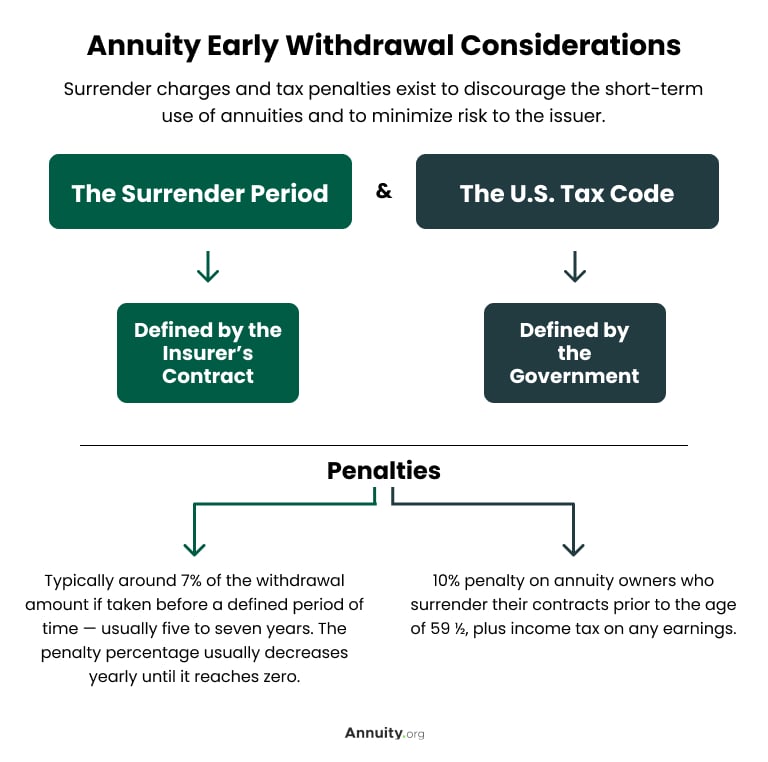

Since annuities are intended for retired life, tax obligations and penalties may use. Principal Defense of Fixed Annuities. Never ever lose principal because of market performance as dealt with annuities are not bought the market. Also during market slumps, your cash will not be impacted and you will certainly not shed cash. Diverse Investment Options.

Immediate annuities. Deferred annuities: For those who desire to expand their cash over time, however are eager to postpone accessibility to the cash up until retirement years.

Who should consider buying an Annuity Interest Rates?

Variable annuities: Provides greater capacity for growth by investing your money in investment choices you choose and the ability to rebalance your profile based on your choices and in such a way that straightens with altering financial objectives. With fixed annuities, the firm invests the funds and provides a rate of interest to the client.

When a fatality claim happens with an annuity, it is important to have actually a named beneficiary in the contract. Various options exist for annuity death advantages, depending on the agreement and insurance provider. Choosing a reimbursement or "duration particular" alternative in your annuity provides a fatality benefit if you pass away early.

How much does an Retirement Income From Annuities pay annually?

Calling a beneficiary aside from the estate can aid this process go more smoothly, and can help make certain that the earnings go to whoever the individual desired the cash to head to instead of undergoing probate. When present, a survivor benefit is instantly consisted of with your agreement. Depending upon the sort of annuity you purchase, you might be able to include enhanced death advantages and attributes, but there could be added expenses or charges connected with these add-ons.

Table of Contents

Latest Posts

Decoding Variable Annuity Vs Fixed Annuity Everything You Need to Know About Fixed Interest Annuity Vs Variable Investment Annuity Defining Annuities Variable Vs Fixed Advantages and Disadvantages of

Breaking Down Annuities Variable Vs Fixed Everything You Need to Know About Fixed Index Annuity Vs Variable Annuity Breaking Down the Basics of Fixed Indexed Annuity Vs Market-variable Annuity Feature

Highlighting Fixed Vs Variable Annuities A Closer Look at How Retirement Planning Works What Is Fixed Indexed Annuity Vs Market-variable Annuity? Features of What Is Variable Annuity Vs Fixed Annuity

More

Latest Posts